Here is the update on the various monthly models I track. This report is built for those very busy professionals that can’t look at the market much more than once a month but still want to avoid bear markets📉 and beat the market🚀. These models all trade very infrequently.

I keep track of only a few tried and true, time tested “Macro” data points. Those will keep you out of high inflation, rampant speculation and inform you of incoming poor economic conditions.

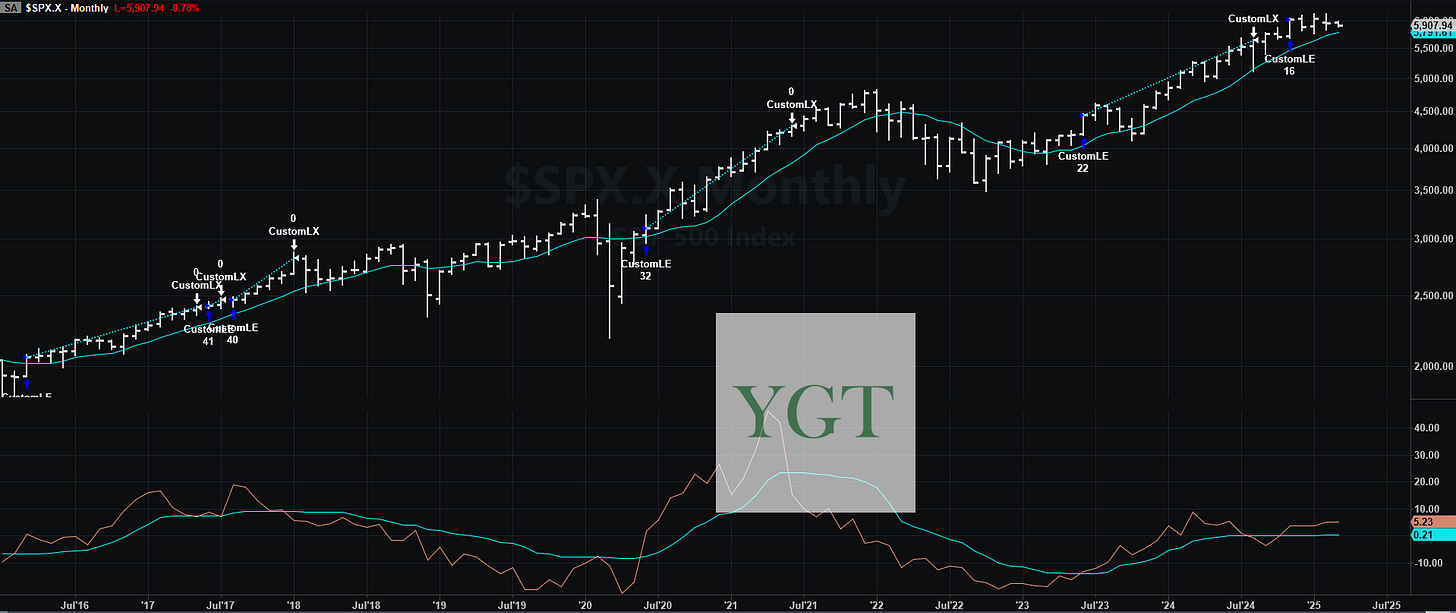

Let’s look at the models!

ISM PMI (Updated March 3rd, 2025)

This model is a broad measure of how well the manufacturing industry. Why keep track of the manufacturing industry? Because it’s the single most sensitive area of the economy🏭. When manufacturing catches a cold🤒, it leads the stock market most of the time - the stock market gets sick shortly afterwards🤮.

Purchasing manager’s index for ISM this month was just OK. We over 50, which is technically expansion - which is objectively good. Some of the subcomponents (not shown) were terrible though. Prices paid subcomponent was well north of 62 now and highest since Sept 2024 - inflation is kicking up extremely fast and aggressively due to tariffs. We have only spent 2 tiny months over the 50 mark for the last 2 YEARS and it looks increasingly likely it’s just due to an artificial bump from businesses “front running” purchases due to tariffs. All of that will produce a massive hangover afterwards - demand will collapse. This is like going to the store and buying coffee ☕ahead of time because it’s on sale - you might buy 2 or 3 times the amount of coffee you need in a month today, but next month and the month after that you won’t buy anything because you already have stocked up on your coffee. That’s what is happening now. This could be very bad over the next 6 months. Very disappointing to see😔.

The equity curve for the model is shown, so you can see that it’s very good and it goes ALLLLLLL the way back to 1960.

CPI and PPI (Inflation Numbers, Updated Feb 15-18th, 2025)

Keep reading with a 7-day free trial

Subscribe to You Got This Trading to keep reading this post and get 7 days of free access to the full post archives.