Welcome to the morning report, where I go over the setup for the day as it relates to day trading. I’ll review levels using options gamma and show you where the support and resistance lie along with some other proprietary metrics like options skew that have good track records for forecasting bullish or bearish tendencies for the day.

Let’s see what the day has in store for us!

Today’s Setup

We are treading water again this morning. Note will be short, I’m moving today.

We got the Trade Deficit this morning - which is narrowing, probably what MAGA wants to see. This is happening as unemployment and joblessness is spiking in some of these Manufacturing hubs like Michigan. That might sound confusing to you, but most of this is the result of front-loading demand ahead of Tariffs, not the Tariffs themselves.

The unemployment data continues to reflect persistent increasing claims. This week it was Minnesota and Kentucky joining Michigan last week with unexpected, large increases in unemployment. Michigan this week actually wasn’t too bad - but last week was so bad that this week doesn’t make up for it.

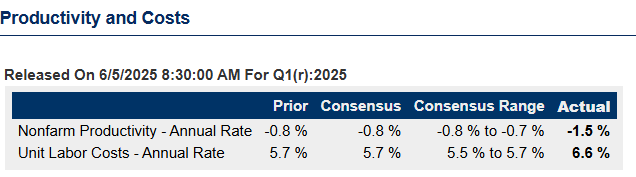

Productivity is here and it sucks. Look at these unit labor costs…6.6% inflation and skyrocketing. 🤯🤯 This is very important to understand. We are starting to see large increases in wages - these will flow through into the headline CPI number in the late Summer. Right now, the headline inflation numbers are being held down with the oil prices declining and some of the rent going down.

Keep reading with a 7-day free trial

Subscribe to You Got This Trading to keep reading this post and get 7 days of free access to the full post archives.