🌋Vix Is Already Running, I'm Not Screwing Around Here

Daily Market Model Update for 9/15/25

*This one is long, make sure you click through to the site to read it, because your email provider might cut off the bottom of the email and there are some good charts in there at the bottom!*

Welcome to the Daily Report where I review what happened in the past trading day, the driving forces behind the moves🚀. At the end of the day, I publish the signals from a Short-Term trading portfolio that trades between 4 -10 day holding periods (currently beating the S&P500 by a lot this year), an Intermediate Term Portfolio that holds for about 3 months on average targeting 15-25% yearly returns, and the actual signals I use for trading my retirement accounts using mean reversion (5 different systems that average 10-20% yearly gains on the indexes). Everything comes with back tested results on the setup📝 and the entries and exits always happen at the end of the day so you can buy and sell in the after-hours session (or on the open the next session if you prefer). I personally trade these signals, so there is no funny business here. I eat my own cooking🍳.

Let’s review what happened today!

What Drove Today’s Move

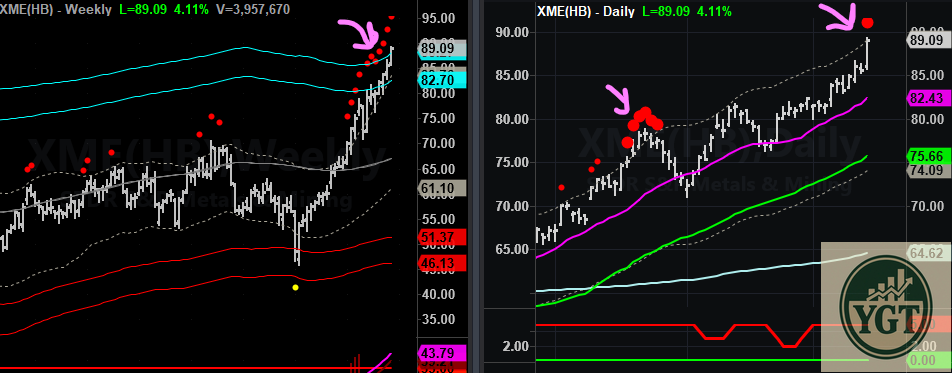

Today we continued to see the culmination of the insider trading going on with TSLA 0.00%↑ spread to other areas of the market (nuclear stocks, gold stocks were egregious today).

If you are in some of those names, it’s time to ring the register.

As far as TSLA 0.00%↑ TSLA goes, it’s still squeezing - we’ll have to see if this Anchored VWAP breaks tomorrow. Here is that level if you are interested. It’s around 400. Once we push under that, it’s probably over.

DJT 0.00%↑ DJT has so far avoided participating in this melt up. That probably changes soon - we could see some of the Conservative sentiment around the violent events this week bleed into this thing - after all we know these guys never miss an opportunity to cash in when there is panic among the base. I have some YOLO calls on this one that are starting to print now.

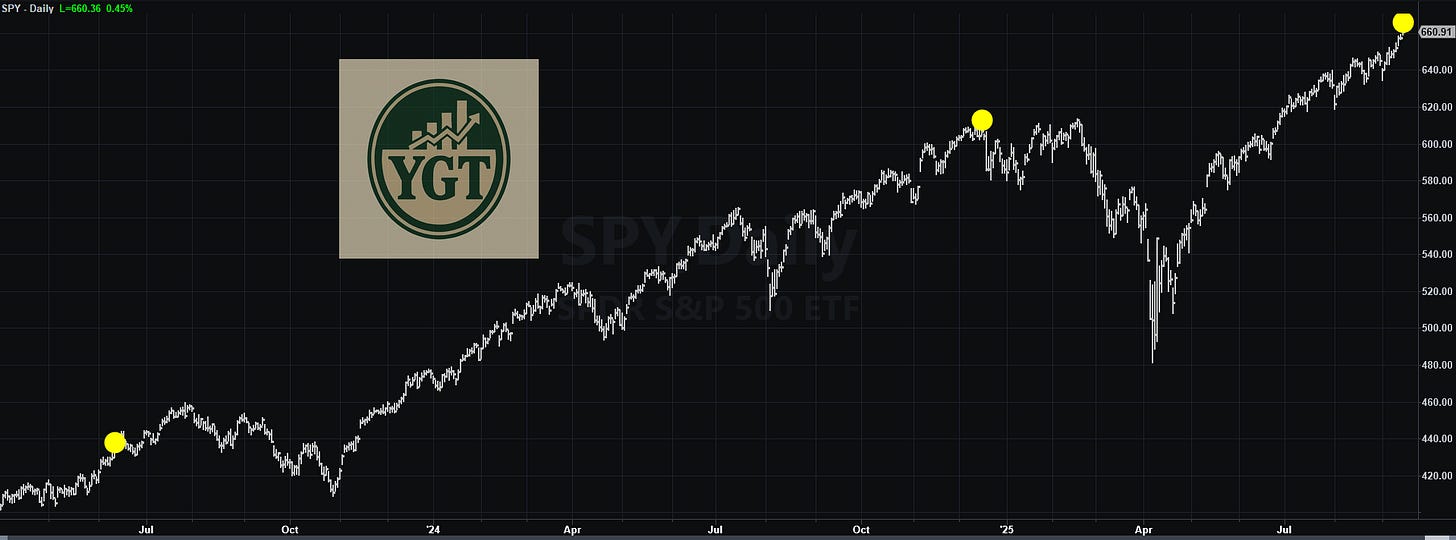

$VIX was not impressed with any of this bullcrap. It was up 6% today. I’ll share some nice numbers with regard to what normally happens after Expiration on Vix (which is Wednesday). This is your equity curve buying Vix Wednesday at the close and holding through next Wednesday. Notice we are seeing the equity curve kind of wilt since October of 2024. I’ve also circled the 2016-2018 period, prior to when Trump screwed up and started the Trade War and COVID came. We had the same kind of Euphoria as his “type” of investor (I’ll put it nicely) barreled into the market and professional funds ran for the hills.

We are seeing the market structure itself a little different than normal. But we can also see that the last time this happened, it didn’t last much longer than this either.

Here are the last couple times we have seen QQQ 0.00%↑ up this much and $VXN (the Vix for the QQQs) up this much in one day.

I’m not screwing around here people. This setup is extremely poor now. You have been warned!

If you want to read about the last time I called the top before the Bear Market, go here:

Keep reading with a 7-day free trial

Subscribe to You Got This Trading to keep reading this post and get 7 days of free access to the full post archives.