Weekly Models Update - Earnings Take Over + Trade War Hopium 😵💫

Weekly Market Model Update for April 26th

Welcome to the weekly report! This report is targeted at investors that don’t have time to monitor the ebbs and flows of the market day to day and still want to beat the market and avoid bear markets🚀. Just 10 minutes a weekend is all it takes.

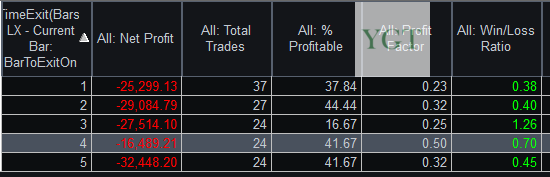

I focus on the MAJOR themes and the MAJOR trends of the markets in this report. All the models I present are back tested with results so you can see that they work🤔.

This post is long - so make sure you read it on the Substack App or Website so you get to see the bottom of it - Email can often cut the message short. Let’s get into the weekly models!

What Happened This Week

This week we saw earnings take over a little bit and return a bid to some of the mega cap names like TSLA and GOOG. That’s refreshing because by Friday, we had seen markets get overbought enough for the Breadth to take a hit. We only had 40% of stocks up on Friday but the indices were well north of 0.7% gains. This can only be accomplished by some heavily lifting of just a few stocks.

Believe it or not, that is a bullish characteristic and something that has been missing for months now.

GOOG is finding savvy buyers from the last Bear Market bottom return to the market and load the boat up again.

Scott Bessant held some meetings with private investors and pretty much tipped them off that the market rally was incoming - how this is legal, I’ll never know but one thing I know about markets is that they are not free and they are not fair and if you want to succeed you need methods that assume someone always knows something.

Stocks finally rose for 4 days straight. Which brings me to this week’s Show and Tell.

Weekly Show and Tell

Each week I review a chart or model that I would normally keep behind the paywall, I hope you can make a couple bucks off of it! 🤑

This week we’ll show a pretty simple study and that is just what happens after we close higher for 4 days in a row while under the 200 Day Moving Average. It’s very Bearish normally. Only 17% chance of higher by the middle of next week. If you knew this kind of information, do you think you would be pressing longs here? No! We were selling into this strength and getting ready to take on new longs soon.

Keep reading with a 7-day free trial

Subscribe to You Got This Trading to keep reading this post and get 7 days of free access to the full post archives.