Welcome to the weekly report! This report is targeted at investors that don’t have time to monitor the ebbs and flows of the market day to day and still want to beat the market and avoid bear markets🚀. Just 10 minutes a weekend is all it takes.

I focus on the MAJOR themes and the MAJOR trends of the markets in this report. All the models I present are back tested with results so you can see that they work🤔.

This post is long - so make sure you read it on the Substack App or Website so you get to see the bottom of it - Email can often cut the message short. Let’s get into the weekly models!

What Happened This Week

This week the news was dominated once again by headlines, but the volatility was low so most of the dips were scooped up quickly. We have been trading in a market with a high tendency to mean revert, which is leading to some pretty good trading for us.

The economic data was terrible again this week, but the one data point that seemed to “beat” expectations was the only one the market seemed to care about. That was the jobs data on Friday. Under the surface the report was weak - Labor Participation Rates edged lower and the actual areas of the economy seeing job gains narrowed significantly. But the market seems to be shrugging off bad reports and pay attention to “good” ones. 🤷♂️

The government numbers for jobs were not matched this week by the ADP Report. Poor ADP has been trying for years to get their numbers to match the government numbers (because the government numbers are fudged significantly). At one point shortly after COVID ADP actually stopped posting numbers for a few months because they couldn’t get theirs to match the government ones. I would go with ADP for the real reality, but the Government numbers are what moves markets and that is what it is.

Services PMI (US Economy is well north of 70%+ Services related) was awful this week and that is something I’m paying very, very close attention to. We actually found a way to get into CONTRACTION on the services PMI, which is pretty rare. We were supposed to print a 52 and we got a 49.9. That sucks! Here is the breakdown of various areas so you can really dig into it.

You can tell which one I am interested in. Look at Prices. It is sitting at 68-69. We don’t want that thing up that high. That is eye watering. These are levels commensurate with 6-8% inflation, probably more. Look at the various metrics. Inventory is too high, order backlogs are contracting, new orders contracting. All of this is reflecting demand falling off a cliff.

Who the hell is going to be buying all this crap retailers stuffed their warehouses with in order to escape the tariffs? No one! Target did this the last time Trump did Tariffs in 2018-2019 ahead of Christmas and it killed them when no one bought the stuff. They had to discount it all in the Spring and take a massive hair cut on earnings. Now the rest of retailers are making the same mistake. This will hit earnings of companies like a lead pipe across the face.

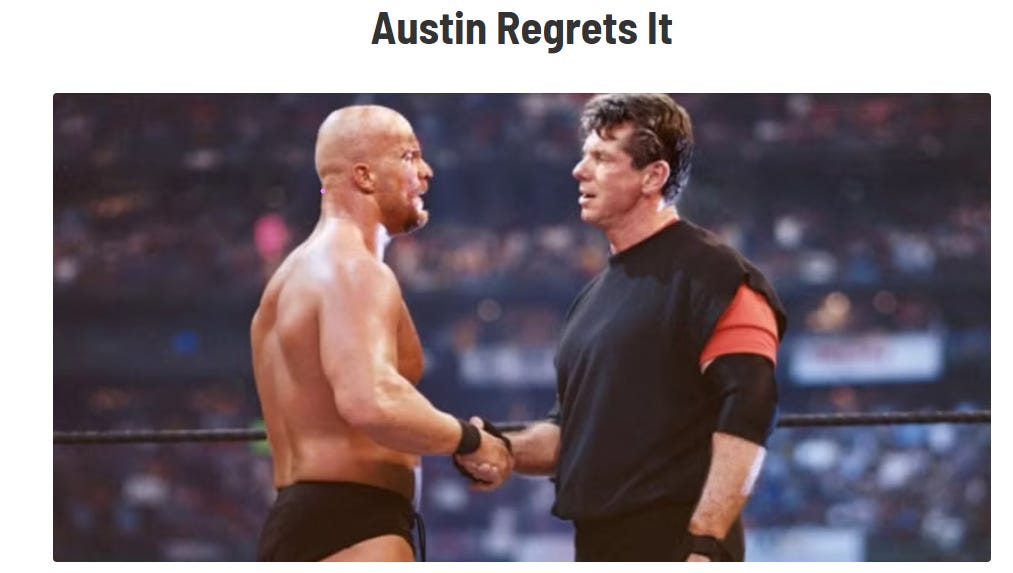

Now - on to the main event of the week. 🔔 This week we witnessed a true WWE moment when Elon Musk turned Heel on Trump. Perhaps Elon Musk was watching WrestleMania in 2017 and realizes just how much “Stone Cold” Steve Austin regretted actually joining forces with Mr. McMahon in order to get the World Championship Belt in 2001. I know because I was watching it back then.

Elon is a lot like Steve Austin - he’s much, much more anti-authority than he is pro-Republican. It’s starting to show now that Republicans are in charge and Elon realizes that they don’t really care about fiscal responsibility (Elon doesn’t either). But Musk has a main goal of reduction in taxes for himself and increased corporate welfare for his companies. The government needs to spend less on the poor, the elderly, the unfortunate and even the military to make Elon and the Billionaire class number one. This is pretty fun to watch, just like WrestleMania 17 was must-see TV back 20+ years ago.

What does it mean for markets? Probably not much other than this is probably the opportunity for Trump to distance himself from the very unpopular DOGE activities. Trump will say something like he never ordered any of that (even though he did) and he doesn’t recall this or that and the media will most likely give him a pass if he says it enough times and it gets into his schtick. The key will be to find a way to plausibly deny responsibility for bringing it in here in the first place. I just wonder what MAGA will do with those TSLAs they are driving now (I see lots of Mercs swapped for a TSLA down here in the Great State).

Whether or not the blowback will come in November 2026 is unclear to me at this point. Markets will definitely like the DOGE stuff going away because it was a waste of time / money. The big issue now with that stuff is that it’s slowly metastasized like Cancer into the State and Local governments now. The knock-on effects will be large and take a year or two to shake out, if not longer. The standards of living for everyone will be reduced as a result.

A lot of really useful people are quitting local and state government now because they aren’t going to put up with the politics and they’ll get jobs doing something better pretty easily because they have skills no one else has (e.g. they can manage old legacy systems that governments won’t update, no matter who is in charge). That leaves people who can’t/won’t do, people who always say yes to whatever comes across their desk and others who just can’t afford to leave. Not a great way to do business as the government. I’ve seen organizations die when stuff like that happens.

If DOGE is dead and Elon is out (maybe Steve Bannon is tagged back in now), then you know what is going to need to happen. The Admin will need adults to come back in and clean up the empty beer bottles and wrecked furniture and turn the lights back on after the DOGE Broheem Bender. Guess who does that? Booz- Hamilton of course. I like the position of the stock here on the weeklies and there is no reason to think the government is going to be capable of fixing what it tore up by itself. It will need private industry and consultants to come back in and tell them how to do it right again because the Brain Drain is Biblical up there right now.

Weekly Show and Tell

Each week I review a chart or model that I would normally keep behind the paywall, I hope you can make a couple bucks off of it! 🤑

This week we will review the options flow on the SPY ETF (and other ETFs) to see what we can glean. Options flow is reflected by the red line in the bottom clip on this chart. What do you notice? As price has traded sideways (and broken out to the upside this week) we have seen the red line nose-dive. That indicates people are piling into Puts here thinking this is going to roll over and go down.

This kind of behavior naturally supplies a “Floor” under the market. This is actually the “Wall of Worry” the market climbs - it climbs upward and when it slips and falls there are piles of puts waiting to catch it on the way down, supporting it. I have to admit this doesn’t look too bad here and it could squeeze shorts next week if we get any good news.

We have been trading at a normal to slightly more aggressive than normal pace in the Portfolios successfully and next week will continue to do the same because of these kinds of metrics.

Keep reading with a 7-day free trial

Subscribe to You Got This Trading to keep reading this post and get 7 days of free access to the full post archives.